Maximum Allowed 401k Contribution 2025. 401(k) plans are also subject to several contribution limits. If you're age 50 or.

401(k) contribution limits are set by the irs and typically increase each year. The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2025 to $71,000 in 2025.

The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000.

The Maximum 401k Contribution Limit Financial Samurai, The total maximum allowable contribution to a defined contribution plan (including both employee and employer contributions) is expected to rise by $2,000. The 401 (k) contribution limit for 2025 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

Maximum 401(k) Contributions What to Know, Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025. The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, $19,500 in 2025 and 2025 and $19,000 in 2019), plus $7,500 in 2025;. 401(k) contribution limits are set by the irs and typically increase each year.

401(k) Contribution Limits Everything You Need to Know Ultimate Assets, However, there is a limit that. The 401 (k) contribution limit is $23,000 in 2025.

What are 401k Contribution Limits? Planning Made Simple, 401(k) contribution limits are set by the irs and typically increase each year. The total maximum allowable contribution to a defined contribution plan (including both employee and employer contributions) is expected to rise by $2,000.

401(k) Contribution Limits in 2025 Meld Financial, 401(k) plans are also subject to several contribution limits. The total maximum allowable contribution to a defined contribution plan (including both employee and employer contributions) is expected to rise by $2,000.

Maximum 401(k) Contribution for 2025, The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000. Defined contribution retirement plans will be able to add.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, What are highly compensated employees? For tax years starting in 2025, an employer may make uniform additional contributions for each simple plan employee to.

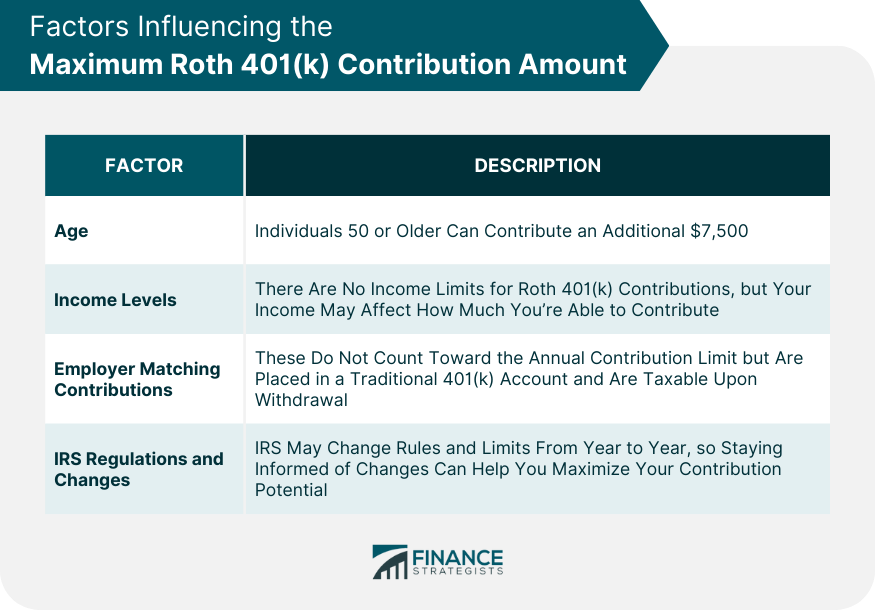

Understanding and Maximizing Your Roth 401(k) Contributions, Highly compensated employees (hces) are employees who earn more than the irs maximum allowable compensation. $19,500 in 2025 and 2025 and $19,000 in 2019), plus $7,500 in 2025;.

Maximum 401(k) Contribution for 2025, Defined contribution retirement plans will be able to add. 401(k) contribution limits are set by the irs and typically increase each year.

The internal revenue service said friday that it will boost the maximum contribution limit to employee 401 (k) accounts by $2,000 next year to $22,500, the largest increase on record,.